Is The New 3% Conventional Mortgage The Right Choice For First Time Home Buyers

2015 is gearing up to be an exciting year in real estate as changes in credit score requirements for FHA borrowers, and a new 3% downpayment Conventional loan available make qualifying for a home loan easier for first time buyers entering the housing market. On top of these changes, there are also 100% backed VA loans, which are backed by the Department of Veterans Affairs, and the Rural Housing loan from the USDA (United States Department of Agriculture) that requires no-money-down. With interests rates still near record lows, these offer multiple affordable options to first time home buyers.

Let’s start by determining if you qualify as a “First Time Home Buyer”.

A first time home buyer, as determined by Fannie Mae is someone who has been a home owner over the past three years. If you are married, only one of the borrowers applying for the loan need to meet this requirement to be considered applying as first time home buyer status.

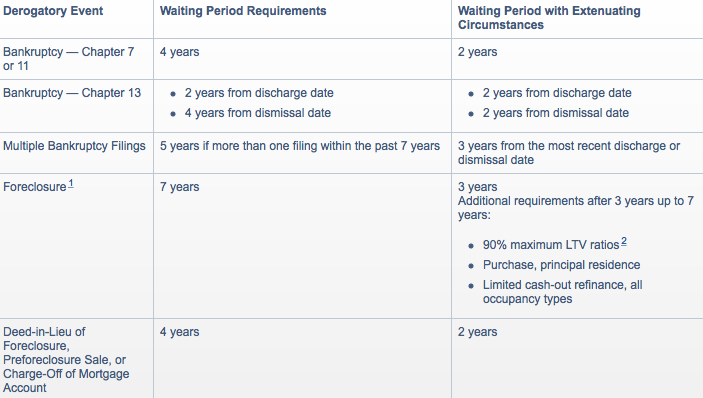

Other considerations could include the waiting period for derogatory events in your financial history before you can qualify for a new loan. This chart is from the Fannie Mae website, and gives the different waiting periods for things like bankruptcy, and Foreclosure. Qualifying for a loan following a short sale has several determining factors. It can be done in only one year if you meet the requirements of the FHA “Back to Work Program”, typically recovery from a short sale takes 3 years to qualify for a 3.5% down FHA loan.

The ups and downs of the 3% conventional mortgage loan.

The new 3% conventional loans were designed to assist low to medium income home buyers, although it is important to remember that these buyers will have to go through the same qualification process as borrowers applying for more traditional 5% down loans. To be considered, the loan will have to have a fixed-interest rate, and PMI (Private Mortgage Insurance) is required. PMI insurance is not cheap with a rate factor of 1.499%, this adds up to approximately $125.00 a month per $100,000.00 borrowed. The upside is that you will not have to pay the upfront PMI as required by FHA of 1.75%, and PMI cost will lower after 11 years.

Additional guidelines for what properties qualify for the 3% conventional mortgage loan.

Approved properties include:

Owner Occupied Only

Single Family Homes

Detached PUD and Town homes

Warrantable Fannie Mae Condos

Properties to are not Elligible:

Investment Properties - Non-Owner Occupied

2-4 Family Units

Manufactured Homes

Property Flips - Owner must have had title for at least 180+ days.

Family Sale / Identity of Interest

This graph and more information can also be found at TheMortgageReports.com

This information really just scratches the surface, but should give you some basic knowledge when you speak with a mortgage lender to determine which programs will work best for your circumstances.

Comments

Post a Comment